Expert Insights: Part 3 – Powering Profitable Decision Making

By Declan Rodger | 6 May 2025

By Declan Rodger | 6 May 2025

This article is the third in our 3-part Expert Insight series where we have talked with Operations Director, Adam Whittick, about the path to profitable decision-making.

In the first article – Get Set, Go!– we looked at both the journey to profitable decision-making and the challenges faced by the finance function. We discussed how removing the non value-adding activities and creating a single version of the truth was the essential foundation for embarking on the journey.

In Beyond First Base, Adam explained that whilst there is no pre-defined route for the journey, there is a right and a wrong approach. The right approach ensures the finance function don’t have a systems implementation ‘happen to them’ and are able to remain close to the underlying data.

Part 3: Finance at the Heart of the Business – Powering Profitable Decision-Making

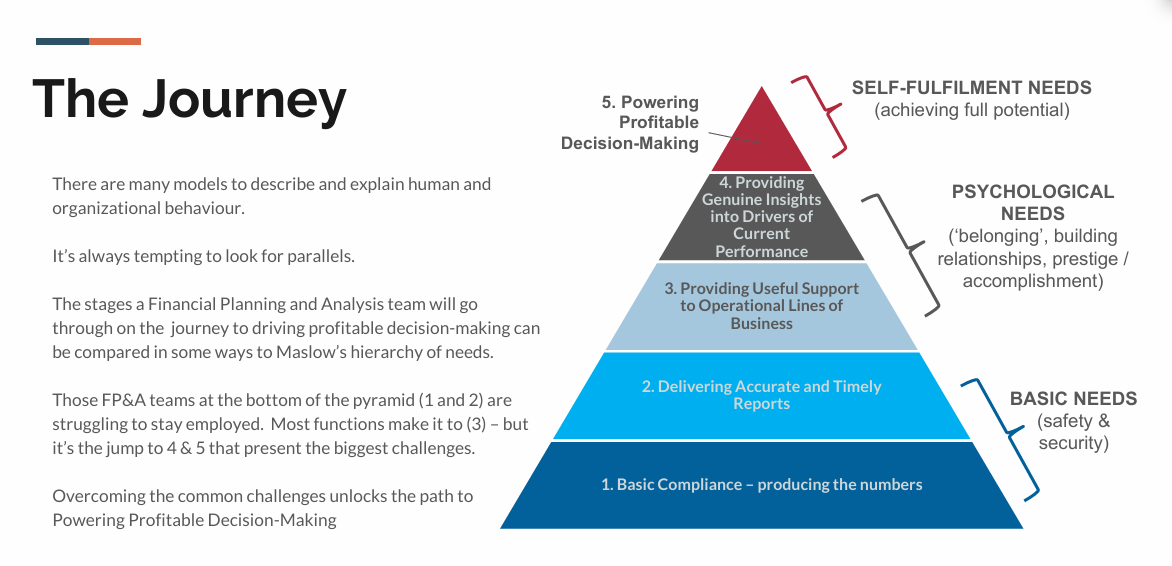

The Path to Profitable Decision-Making is a series of ‘states’ that a finance function tends to pass through. As we discussed in our last article, the route through these states is not pre-defined, but the end state is one where finance is not just reporting on performance but providing accurate insights on opportunities and risks that inform decision-making on the future of the business.

Adam is quick to point out that this can feel almost impossible when the team is stuck in the monthly cycle of gathering and consolidating data and trying to crunch through thousands of spreadsheets.

“There becomes a point in forecasting this month’s data when you’re already halfway through the following month – the information cannot be acted upon. But that’s where people end up. Not having the data in your hand as soon as you possibly can at the start the month – that can really set you back and set you on a bit of a losing streak. It’s a feeling I remember well, almost a case of asking the business ‘Can you stop so we can catch up?’.”

Some of the challenge is clearly speed, but the time taken to produce numbers saps resource and energy. The team are spending all of their time gathering data and preparing numbers – which is not necessarily value-adding. If this time can be flipped – where the team are spending time working with the numbers – then that moves the team forward.

“Removing the grind, creating a single version of the truth and having flexibility to work with the numbers is a massive first step. Having such a system in place makes it possible to react to changes in high level numbers quickly immediately starts to create a benefit.”

So being right on top of the numbers in real time is where the finance function starts to add value?

“Absolutely! For example, if you’ve focused in on a budget model based on a rate per item and the production costs for that item change then that creates risks and opportunities. At first just being able to respond quickly and adapt plans to take advantage is valuable. But this responsiveness also builds knowledge about the economics of the business – the combination of increased understanding and more time to work with it means you can run ‘what-if?’ scenarios around key business drivers and instead of responding to change the business can pre-empt it – or even make it happen to its advantage.”

How does this affect the finance team’s relationship with the rest of the business? In the ‘triangle’ we draw a parallel with Maslow’s hierarchy of needs as the team start to build valuable relationships across the business.

“You can clearly see where finance teams are building tighter relationships when their numbers are providing genuine insights. I’ve seen examples of this in some of the most basic business models where the production teams now better understand the tools that they use – they understand the costs of those tools and they can work together to try and reduce the cost of the tools. You really see the difference of finance people that are really plugged in like that and they get a lot of benefit. They’re really close to the business department. Planning is much easier because they know each other’s needs and how they work”.

Presumably this becomes even more valuable when the business is more complex?

“Very much so. Think about a business with lots of products, lots of customers and spread over multiple regions – a big geographical spread. It’s not easy to piece all of the information together in the first place. But if the team can get to grips with the price / volume / customer data then the insights are enormously valuable. If you’re pushing a product into a region, the business is putting all of its effort into it and it’s not giving you the returns that another product in another region could then that’s enormously powerful insight. This isn’t just helpful in finance – it’s providing guidance to the rest of the business.”

“In the past I saw it when I was working with a luxury car manufacturer. If thousands of cars each year are being produced – within finite production capacity – and we can see that, for the sake of argument, convertibles are flying out of the show-room in the middle East at higher margins then that’s interesting. If we can then model what focusing on that opportunity would do by looking up and down the supply chain – identifying and understanding the trade-offs required to seize this opportunity – then that’s not just interesting, it’s powering the business.”

This is finance putting itself at the heart of the business then?

“Yes – it starts with having the numbers in the first place, but once that foundation is in place the ability to move quickly and be flexible allows the finance team be responsive to change and help the rest of the business apply the appropriate level of management focus”

“In some cases – for example with Robertson Group – it means that for a group of 22 companies running hundreds if not thousands of projects simultaneously, they can report and understand exactly what is going on across the group. They can adapt their management regions at the touch of a button to ensure focus is where it needs to be – and they can deal with the dynamic nature of construction projects in real time.”

“In others, like Edrington, the financial models are almost central to their business. The product they sell is Single Malt Whisky – the longer they keep it in the cask, the more valuable it becomes. But they need sales today to provide revenue – and if the product is not in the market then the brand value is diminished. Understanding stock levels, sales and demand across multiple geographies is vital. Their stock depletion models help them to optimize what they sell now, what they produce and how long they mature it for. These finance models are genuinely driving decision-making about sales and future value.”

Posted 2 months ago in Articles. Filed in Consultancy, Design & Implementation, Finance & Professional Services.